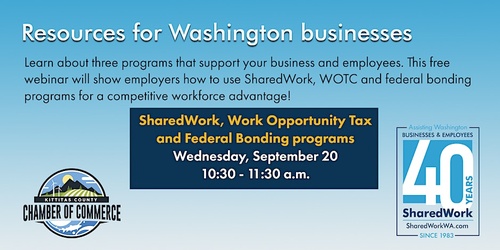

SharedWork Webinar Work Opportunity Tax Credit

Join us for a free webinar in partnership with SharedWork on Work Opportunity Tax Credit and Federal Bonding!

What you'll learn about Work Opportunity Tax Credit Services:

- Finding an available workforce that provides tax incentives and bonding protection for peace of mind.

- Reduce your federal income tax liability by $2,400 - $9,600 per employee.

- How to apply easily and quickly using the online filing system.

- Submit all applications within 28 days of the employee's start date and help your business and workers thrive.

- Answers to the most common WOTC and Bonding - employer questions.

- The Federal Bonding Program protects employers against employee theft, forgery, larceny, and embezzlement.

- Employers can be issued free of charge, zero deductible bonds for between $5000 and $25,000 for each justice involved new employee.

Date and Time

Wednesday Sep 20, 2023

10:30 AM - 12:00 PM PDT

September 20, 2023

10:30 a.m - 11:30 a.m

Location

Fees/Admission

Free

Contact Information

Katie Estes, Director of Chamber Outreach and Economic Advancement

Send Email